Frequently Asked Questions

Results (35)

Click the question to read the answer.

-

There are only two allowable deductions for Blue Box materials. There are for materials that are:

- collected from an eligible source at the time a related product was installed or delivered (e.g., packaging that is removed from the house by a technician installing a new appliance). This is the “installation deduction”.

- deposited into a receptacle at a location that is collected from a business or institution where Blue Box collection services are not provided under the regulation. This is the “ineligible source deduction” that was expanded by the regulation amendment in July 2023.

Ineligible source deductions:

Blue Box Producers may deduct materials that are collected from a business or institution where producers are not required to provide Blue Box collection services. Examples include offices, stores and shopping malls, restaurants, community centres, recreation facilities, sports and entertainment venues, universities and colleges, and manufacturing facilities.

Producers cannot deduct the following materials collected through the collection systems established under the Blue Box Regulation:

- Material that is generated at a facility (including multi-residential buildings, retirement homes, long-term care homes and schools).

- Material that is collected from a residence through a curbside or depot collection service.

- Material that is collected from a public space (including an outdoor area in a park, playground or sidewalk, or a public transit station).

- Material collected under an alternative or supplemental collection system.

- Beverage containers cannot be deducted.

Materials that are deducted cannot count toward a producer’s management requirement.

Please see the Reporting Guidance Ineligible Source Deductions for the 2024 Blue Box Supply Report for more information on how to determine and use these deductions.

-

Producers are required to provide the following information when registering with RPRA:

- Contact information

- PRO information (if a PRO has been retained at time of reporting), including what services they have retained a PRO for

- Their 2020 supply data in each of the seven material categories– beverage container, glass material, flexible plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

Please note that this information must be submitted to RPRA directly.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

Starting in 2022, producers are required to report their supply data annually to RPRA.

Each year, producers will need to provide the previous years’ supply data in each of the seven material categories – beverage container, glass material, flexible plastic, rigid plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

Yes, there are some key changes to the data reported to Stewardship Ontario and what needs to be reported under the new regulation, which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- There are fewer reporting categories than under the Stewardship Ontario program

- Certified compostable packaging and products now must be reported separately, but this category does not have management requirements

- There are only two deductions permitted under the Blue Box Regulation, and producers must report total supply and then report any weight to be deducted separately

- Exemptions are based on tonnage supply under each material category instead of a total supply weight threshold of less than 15 tonnes as in Stewardship Ontario’s program

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”; “Are there exemptions for Blue Box producers?“; “Are there any differences in Blue Box producer hierarchies between the current Stewardship Ontario program and the new Blue Box Regulation?”; and “Are there are any differences in obligated Blue Box materials between the current Stewardship Ontario program and the new Blue Box Regulation?”

-

No, beverage containers are not eligible for this deduction.

The allowable deduction is permitted for Blue Box materials that are deposited into a “non-eligible source,” meaning a place where consumers dispose of Blue Box materials that are not included in the producer-run collection system.

Under the Blue Box Regulation, beverage containers that are supplied to Ontario consumers for personal, family, household or business purposes are obligated Blue Box materials. The inclusion of “business purposes” is unique to the beverage container material category.

Because supplying a beverage container can mean either supplying for “personal, family and/or household purposes” that will likely be consumed and disposed of in a residential context (e.g., a home, apartment, long-term care facility, etc.) or supplying for “business purposes” that will likely be consumed and disposed of in a commercial or institutional context (e.g., a restaurant, college or gym), there are no “non-eligible sources” for beverage containers. All beverage containers must be reported and collected from all sources, whether they are residential, business, commercial or institutional.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

Public sector institutions, such as colleges and universities, are suppliers of Blue Box materials to consumers in Ontario. They supply Blue Box materials to consumers on-site (e.g., food service packaging, unprinted paper in photocopiers, etc.) and off-site (e.g., mailings).

For the purposes of supply reporting, colleges, universities, and other public sector institutions must determine the total amount of Blue Box material they supply to consumers in Ontario. One way to gather this data is by canvassing internal departments to obtain annual weights of Blue Box materials supplied to consumers on-site and off-site.

Also see:

FAQ: What deductions are available to producers under the Blue Box Regulation?

Compliance Bulletin: What Blue Box materials need to be reported? -

A newspaper producer is a person who supplies newspapers to consumers in Ontario. For the purpose of the Blue Box Regulation, newspapers include broadsheet, tabloid or free newspaper. For further information, see the FAQ: What is a newspaper?

Note that a producer of supplemental advertisements or flyers that are supplied with a newspaper would not be considered a newspaper producer as they do not supply the actual broadsheet, tabloid, or free newspaper. This producer cannot use the newspaper exemption percentage to be exempt from Blue Box collection and management requirements. See the FAQ: Are there exemptions for Blue Box producers?

-

Registrants may request that a Deputy Registrar review a Compliance Order issued to them by an inspector. The request must be made, in writing, by the registrant to a Deputy Registrar within seven days of being served with the order. The request must include:

- The parts of the order that the request for review pertains to;

- Any submissions the person requesting the review wants considered; and

- An address (physical or electronic) where the person can be served with the Deputy Registrar’s decision.

A Deputy Registrar will then review the order and can revoke, confirm, or amend the inspector’s order.

Deputy Registrars must either issue their decision or provide notice that more time is needed within seven days of receiving the request. If a Deputy Registrar provides notice that more time is needed, they must stay (put on hold) the order while it is under review, and the Deputy Registrar must issue their decision within 90 days.

If a Deputy Registrar does not issue a decision or provide notice that more time is needed within seven days of receiving the request for review, the order will remain as originally issued.

Note: This FAQ is for general information only and should not be considered legal advice. Please review the Resource Recovery and Circular Economy Act, 2016 and associated regulations for details.

See the FAQ: ‘Can I appeal a Compliance Order issued to me?’ for information on appealing a compliance order.

-

Registrants who receive a Notice of Intention to issue an Administrative Penalty Order may request that the Registrar or a Deputy Registrar consider additional information before they decide to issue the order. A registrant may ask the Registrar or a Deputy Registrar to review:

- Additional information related to the contravention;

- Any information relevant to the determination of the penalty amount; or

- Any actions you have taken to remedy the contravention since it occurred.

The request must be made to the Registrar or a Deputy Registrar, in writing, within 21 days of the notice of intention being served on the registrant. All additional information and supporting documentation that the registrant would like the Registrar or Deputy Registrar to consider should be included in the request.

The Registrar or Deputy Registrar must then consider the information in the request and determine whether or not to issue an order. If the Registrar or Deputy Registrar decides not to issue the order, they must notify the registrant of this decision.

See RPRA’s Administrative Penalties Guideline for further information or the FAQ: ‘Can I appeal an Administrative Penalty Order issued to me?’ for information on appealing an administrative penalty order.

Note: This FAQ is for general information only and should not be considered legal advice. Please review the Resource Recovery and Circular Economy Act, 2016 and associated regulations for details.

-

A producer’s management requirement is how much Blue Box material they must ensure is collected and processed into recovered resources each year. Management requirements are calculated based on what they supplied into Ontario one year prior and the resource recovery percentage as set in the regulation. A producer’s management requirement is calculated separately for each Blue Box material category (beverage container, glass, flexible plastic, rigid plastic, metal and paper).

Some producer are exempt from having a management requirement based on their supply data, for more information on exemptions see the FAQ Are there exemptions for Blue Box producers? A producer that does not have a management requirement does not have any collection, management or promotion and education obligations.

A producer with a management requirement must also provide collection and promotion and education services in Ontario. Most producers will contract the services of a producer responsibility organization (PRO) to meet their collection, management and promotion and education obligations.

To view your management requirement(s), log into your registry account, download a copy of your Blue Box Supply Report and review the section with your minimum management requirements. Management requirement for a given year are determine by supply data from two years prior. For example, 2023 management requirements were based on 2021 supply data (submitted in producers’ 2022 Supply Report).

Unsure if you are a Blue Box producer? See our FAQs Am I a producer of Blue Box product packaging? And Am I a producer of paper products and packaging-like products?

-

Blue Box materials supplied to a business (e.g., the operators of a long-term care home) are not obligated, however, there are no deductions available for materials supplied to a consumer in an IC&I setting (e.g., a resident of a long-term care home).

Any Blue Box materials supplied to consumers in Ontario are obligated. Blue Box materials supplied to the IC&I sector are not obligated (except beverage containers which are obligated regardless of the sector supplied into).

-

Under the Blue Box Regulation, allowable deductions for producers include Blue Box materials that are deposited into a receptacle at a location that is not an eligible source and where the product related to the Blue Box material was supplied and used or consumed.

This applies to food court restaurants located in a mall or in the base of an office tower. Blue Box materials that were disposed of in the buildings’ recycling receptacles and were supplied and used or consumed within that physical building are an allowable deduction. Blue Box materials that were disposed of in the buildings’ recycling receptacles but were not supplied and used or consumed within that physical building are not deductible.

This does not reduce the obligation of a producer to provide complete and accurate supply data or limit the ability of an Authority inspector to review the data and related records for the purpose of determining compliance.

-

RPRA will accept a report that substantiates the total Blue Box material weight deductions based on the customer’s recorded response to “Will you eat in or take out?” for all locations. Reports must be retained either in electronic or paper format for five years and be provided upon request for verification by RPRA.

-

Under the Blue Box Regulation, allowable deductions for producers include Blue Box materials that are deposited into a receptacle at a location that is not an eligible source and where the product related to the Blue Box material was supplied to a consumer and used or consumed.

This applies to locations such as arenas, college and university campuses and food courts.

A producer must demonstrate the following with regards to an allowable deduction:

- They are the obligated producer for the materials for which they are claiming a deduction, and the weight of those materials was included in their reported supply data.

- The materials were supplied onsite to a consumer for personal, family or household purposes.

- The same materials that were supplied, were used or consumed onsite and disposed of in a receptacle onsite.

Blue Box materials that were disposed of in a building’s receptacles but were not supplied and used or consumed within that physical building are not deductible. This deduction applies to all Blue Box materials supplied for personal, family or household, but not those supplied for business purposes. This deduction is not available for beverage containers.

This does not reduce the obligation of a producer to provide complete and accurate supply data or limit the ability of an Authority inspector to review the data and related records for the purpose of determining compliance.

-

When paying fees to RPRA, you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI; also commonly known as ACH or EFT)

- Electronic bill payment

- Cheque

For instructions on how to submit payment by the method you chose, read one of the following FAQs:

- How do I pay my fees to RPRA by credit card?

- How do I pay my fees to RPRA by bank withdrawal (pre-authorized debit)?

- How do I pay my fees to RPRA by electronic bill?

- How do I pay my fees to RPRA by cheque?

- How do I pay my fees to RPRA by electronic data interchange (EDI)?

To note, Registry invoices are considered due on receipt. Invoices are in CAD funds and payments must be sent in CAD.

-

See our FAQ to understand “What is blue box product packaging?”.

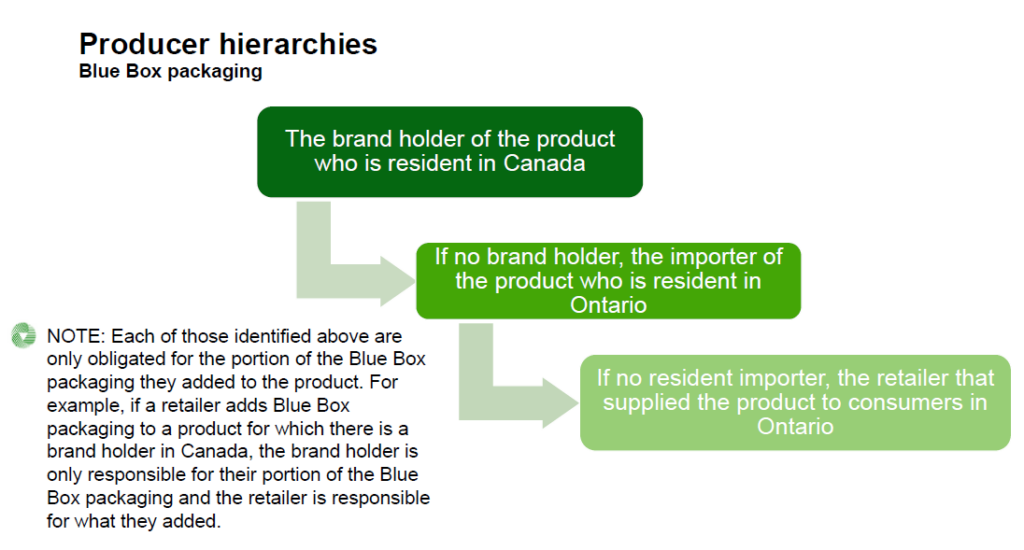

Product packaging added to a product can be added at any stage of the production, distribution and supply of the product. A person adds packaging to a product if they:

- make the packaging available for another person to add the packaging to the product

- cause another person to add the packaging to a product

- combine the product and the packaging

For the portion of the product packaging that a brand holder added to the product, a person is considered a producer:

- if they are the brand holder of the product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For the portion of the product packaging that an importer of the product into Ontario added to the product, a person is considered a producer:

- if they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For any portion of the packaging that is not described above, the producer is the retailer who supplied the product to consumers in Ontario.

-

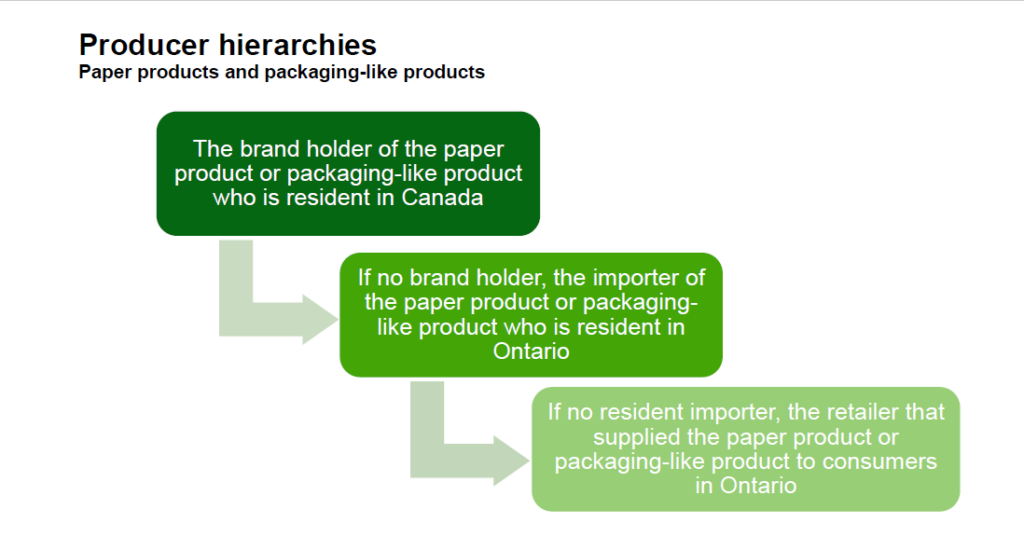

See our FAQs to understand “What are paper products?” and “What are packaging-like products?”.

For paper products and packaging-like products, a person is considered a producer:

- if they are the brand holder of the paper product or packaging-like product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the paper product or packaging-like product from outside of Ontario

- if no resident importer, they are the retailer that supplied the paper product or packaging-like product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

-

Yes, there have been some key changes to the producer hierarchies which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- If a retailer is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer.

- Brand holders that are resident in Canada are obligated, which varies from the Stewardship Ontario program where brand holders that are resident in Ontario are obligated.

See our FAQ to understand “Who is a marketplace facilitator?”.

-

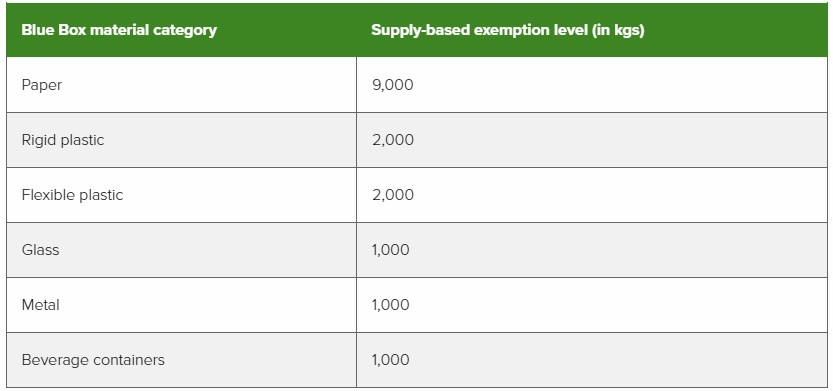

Under the Blue Box Regulation, there are three types of exemptions that apply to producers:

- Based on a producer’s gross annual revenue,

- based on the weight of Blue Box materials supplied into Ontario, and

- for producers of newspaper

1. Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation. In the case where the producer is a franchisor, it is the gross annual revenue of the system that is used to determine if an exemption applies.

Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format that can be examined or accessed in Ontario for a period of five years from the date of creation.

See our FAQs to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

2. A producer who is above the revenue-based exemption level may still be exempt from performance requirements (collection, management and promotion and education) if their supply weight is below the exemption levels outlined in the table below.

If a producer’s annual revenue is more than $2,000,000 and supply weight in all material categories is less than the tonnage exemption threshold, the producer is required to register and report.

If a producer’s annual revenue is more than $2,000,000 and supply weight in at least one material category is above the tonnage exemption threshold, the producer is required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their minimum management requirement in material categories where they are above the exemption level.

3. As outlined in the amended Blue Box Regulation (released April 19, 2022), producers of newspapers may be exempt from collection, management, and promotion and education requirements. For the purposes of this exemption, “newspapers” includes newspapers and any protective wrapping and any supplemental advertisements and inserts that are provided along with the newspapers.

For a producer to qualify for this exemption, newspapers must account for more than 70% of their total weight of Blue Box materials supplied to consumers in Ontario in a calendar year. If exempt, the producer is not required to meet collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario in the following two calendar years.

A producer whose newspaper supply accounts for 70% or less of their total weight of Blue Box materials is subject to collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario.

-

You are a Blue Box processor if you process Blue Box material that was supplied to a consumer in Ontario for the purposes of resource recovery.

For the purpose of resource recovery, processing includes, and is not limited to:

- Sorting

- Baling

- Paper and cardboard shredding

- Plastic reprocessing, which includes grinding, washing, pelletizing, compounding, etc.

- Crushed glass reprocessing

- Aluminum and steel reprocessing

See our FAQs to understand “Who is a consumer under the Blue Box Regulation”.

-

Free riders are obligated parties that:

- Have not registered or reported to RPRA

- Have not established a collection and management system (if they are so required to), or;

- Are not operating a collection and management system (if they are so required to).

See our FAQs to understand “What is RPRA’s approach to free riders?”, and “What do I do if I think a business is a free rider?”

To note:

- Some producers only have requirements to register and report. Please refer to your specific program page on our website to understand producer obligations.

- Collection and management systems may be accomplished by a producer responsibility organization (PRO) on behalf of a producer through contractual arrangements between the producer and PRO. If a PRO is managing a producer’s collection and management requirements, producers must identify that PRO to RPRA.

-

RPRA takes a risk-based and proportional approach to compliance. This approach focuses on the potential risks that arise from non-compliance and assessing those risks to guide the use of compliance tools and the deployment of resources to minimize risk and maximize compliance. Learn more about RPRA’s Risk-Based Compliance Framework.

As a provincial regulator, we have the following powers to bring non-compliant parties into compliance:

- Broad inquiry powers including authority to compel documents and data

- Inspections and investigations

- Audits

- Compliance Orders and Administrative Penalty Orders (amounts to be set in regulation once finalized)

- Prosecution

RPRA’s primary approach to compliance is through communications (C4C – Communicating for Compliance). RPRA communicates directly with obligated parties and informs them of their requirements and when and how they must be completed. A high degree of compliance is achieved with this approach.

RPRA considers free riders a high priority to the programs we administer and focuses compliance efforts on bringing free riders into compliance with the regulations.

See our FAQ to understand “What is a free rider?”, and “What do I do if I think a business is a free rider?”

-

We encourage anybody who believes an entity is a free rider to contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca with information about that entity. RPRA reviews every free rider allegation that is referred to us.

We do not share information about our inspections or progress on specific free rider cases.

See our FAQ to understand “What is a free rider?” and “What is RPRA’s approach to free riders?”

-

A newspaper is a regularly (usually daily or weekly) printed document consisting of large, folded, stapled or unstapled, sheets of paper containing news reports, articles, photographs, and advertisements. Newspapers include broadsheet, tabloid, and free newspaper categories.

Newspapers have traditionally been published in print on low-grade paper known as newsprint. However, not all documents printed on newsprint are considered newspapers. For example, flyers printed on newsprint quality paper supplied separately from newspapers are not newspapers for the purpose of supply data reporting under the Blue Box Regulation.

For the purpose of supply reporting, newspapers include any supplemental advertisements and inserts that are provided with/inserted in them (e.g., a flyer or circular that is placed within the folds of a newspaper). Inserts may be composed of any material including, but not limited to, paper. See the FAQ: How do newspaper producers report their supply of newspapers?

Note that magazines are not considered newspapers; a magazine is a periodical publication containing articles and illustrations, typically covering a particular subject or area of interest, and printed on high-quality paper.

-

For the purpose of reporting annual supply data under the Blue Box Regulation, the weight of newspaper must be reported in the appropriate material categories. For example, newsprint must be reported in the ‘paper’ category, while any protective plastic wrapping must be reported as ‘flexible plastic’.

Then, producers will be asked to indicate what percentage of their total Blue Box material supply was newspaper, including any protective wrapping and supplemental advertisements and inserts, in that calendar year.

See our FAQs: “What is a newspaper?” and “Who is a newspaper producer?”

-

Paints, pesticides, solvents fertilizers obligated under the HSP Regulation along with their primary packaging must be accepted at collection sites collecting the corresponding material. For instance, empty paint cans and pesticide aerosols obligated under the HSP Regulation must be accepted at collection sites collecting paint and pesticides.

See our FAQ to understand “Under the HSP Regulation, is the packaging of antifreeze, pesticides, solvents, paints and coatings obligated?” and “Are containers that are obligated under the HSP Regulation obligated as Blue Box materials?“

-

Yes, a Blue Box producer, or PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can choose to offer collection services to any location. Blue Box producers are required to provide collection services to all eligible sources, as well as public spaces.

Blue Box materials collected from locations that are not eligible sources cannot count towards meeting a producer’s management requirement unless they were supplied to a consumer in Ontario. See this FAQ: Who is a consumer under the Blue Box Regulation?

If a person is co-collecting from locations that are eligible sources and not eligible sources, a person must use a methodology or process acceptable to the Authority to account for materials collected from each type of source. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if materials are collected from an eligible source and a location that is not an eligible source along the same collection route, they must be accounted for separately. When those materials are then sent to a processor, they must also be accounted for separately.

-

Yes, a Blue Box producer or PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can voluntarily choose to collect Blue Box materials that are not marketed to consumers.

Blue Box materials not marketed to consumers cannot be counted towards meeting a producer’s collection or management requirements under the Blue Box Regulation.

If Blue Box materials that are marketed to consumers are co-collected with Blue Box materials not marketed to consumers, a person must use a methodology or process acceptable to the Authority to account for materials supplied to a consumer or not. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if Blue Box materials supplied to a consumer in Ontario are collected along the same collection route as Blue Box materials that were not supplied to a consumer, they must be accounted for separately. When those materials are then sent to a processor, they must also be accounted for separately.

See the FAQ: Who is a consumer under the Blue Box Regulation?

-

For the purpose of reporting supply data under the Blue Box Regulation, the weight of newspaper, including any protective wrapping and supplemental advertisements and inserts, must be reported in the appropriate material categories. For example, newsprint must be reported in the ‘paper’ category, while any protective plastic wrapping must be reported as ‘flexible plastic’.

Then, producers will be asked to indicate what percentage of their total Blue Box material supply was newspaper, including any protective wrapping and supplemental advertisements and inserts, in that calendar year.

When reporting either their total supply or the percentage of their total supply that is newspaper, a producer should only include the weight of Blue Box materials for which they are the producer. For example, if flyers for which there is a different brand holder resident in Canada are supplied along with a newspaper and those flyers have a different brand holder resident in Canada, their weight should not be reported by the newspaper producer. Instead, it is the brand holder of those flyers who would be required to include the weight of those flyers in their own supply report.

See our FAQ: “What is a newspaper?”

-

A First Nation’s transition date represents the earliest date that producers are required to provide the community with either Blue Box service or funding within the Blue Box program. Transition dates cannot be moved or changed.

A First Nation’s community name, reserve name(s) and transition date appearing on the transition schedule means it is an eligible community to receive Blue Box collection service or funding between July 1, 2023, and December 31, 2025. The transition schedule was amended for the last time on February 23, 2024. There will be no more additions to the transition schedule.

Related FAQs:

-

Account admins can manage password resets for all active users in the account. Primary users are also able to manage password resets, but only for active users within the programs they are the primary user for. If secondary users require a password reset, they can reach out to the account admin or primary user to do so.

-

The account admin or primary user navigates to the program homepage of which the user requiring a password reset is enrolled in. The account admin or primary user then clicks their username at the top right of the page to show the drop-down list and selects Manage Users.

In the Active Users table, the account admin or primary user clicks Reset Password on the row for the user they want to reset the password for and clicks Confirm.

The user’s password has now been reset. They will receive an email with a password reset link.

Note: the password reset link will expire within 24 hours. If the link expires before the user creates a new password, the account admin or primary must click “Reset Password” again to restart the process.

See the FAQ: Who can reset passwords in the registry?

-

Registrants may appeal an Administrative Penalty Order issued to them to the Ontario Land Tribunal (OLT). The registrant must serve written notice of their intention to appeal to the OLT and to the Registrar or a Deputy Registrar within 15 days of being served the order. The order will be temporarily stayed (put on hold) until a decision is rendered by the tribunal. The notice must include:

- The parts of the order that the appeal pertains to; and

- The grounds on which the person appealing the order intends to rely at the hearing.

The OLT will hold a hearing, and the OLT may confirm, vary, or revoke the order. The OLT cannot vary the amount of the penalty unless it considers the amount to be unreasonable.

After a matter is decided by the OLT, the registrant or RPRA may appeal the OLT’s decision to the Divisional Court, but only on a question of law and with leave (permission) of the Divisional Court. If a party obtains leave, the appeal of the OLT decision will be heard by the Divisional Court. This process is governed by the Rules of Civil Procedure. The OLT’s decision is not automatically stayed by an appeal to the Divisional Court, but a stay may be granted by the OLT or the Court.

See RPRA’s Administrative Penalties Guideline for further information.

Note: This FAQ is for general information only and should not be considered legal advice. Please review the Resource Recovery and Circular Economy Act, 2016 and associated regulations for details.

-

If a Compliance Order is issued to a registrant by the Registrar or a Deputy Registrar, or if the registrant receives a decision from a Deputy Registrar issued as a result of a Request for Review of an inspector’s order, the registrant can appeal the order to the Ontario Land Tribunal (OLT). The registrant must serve written notice of their intention to appeal to the Registrar or Deputy Registrar who made the order and to the OLT within 15 days of being served with the order. The notice must include:

- The parts of the order that the appeal pertains to; and

- The grounds on which the person appealing the order intends to rely at the hearing.

The OLT will hold a hearing. The OLT may decide to confirm, vary, or revoke the order.

After a matter is decided by the OLT, the registrant or RPRA may appeal the OLT’s decision to the Divisional Court, but only on a question of law and with leave (permission) of the Divisional Court. If a party obtains leave, the appeal of the OLT decision will be heard by the Divisional Court. This process is governed by the Rules of Civil Procedure. The OLT’s decision is not automatically stayed (put on hold) by an appeal to the Divisional Court, but a stay may be granted by the OLT or the Court.

Note: This FAQ is for general information only and should not be considered legal advice. Please review the Resource Recovery and Circular Economy Act, 2016 and associated regulations for details.

-

Where a municipality distributes documents on behalf of another brand holder, the municipality is not obligated to report the paper in its supply. That obligation falls to the brand holder.

For example: A municipality may distribute documents issued by the provincial government (such as marriage licences and court documents) which are usually branded with the provincial agency or ministerial logos and names. In these cases, the provincial government would be the brand holder responsible for reporting these materials in their annual supply data report.

Please see FAQ “Who is a brand holder?” for more information.